With this simple 52 Week Savings Plan you can save over $1300 using the handy free printable with details for weekly savings all year long.

I always say that the key to saving money is having a plan. Whether it’s a shopping plan, a menu plan, or a savings plan – saving money doesn’t happen all by itself.

On the heels of Christmas and the cusp of a new year, you may feel like you need a savings plan more than ever.

Here’s a 52 Week Savings Plan that will help you save over $1300 this year without much effort on your part – other than self-discipline.

52 Week Savings Plan

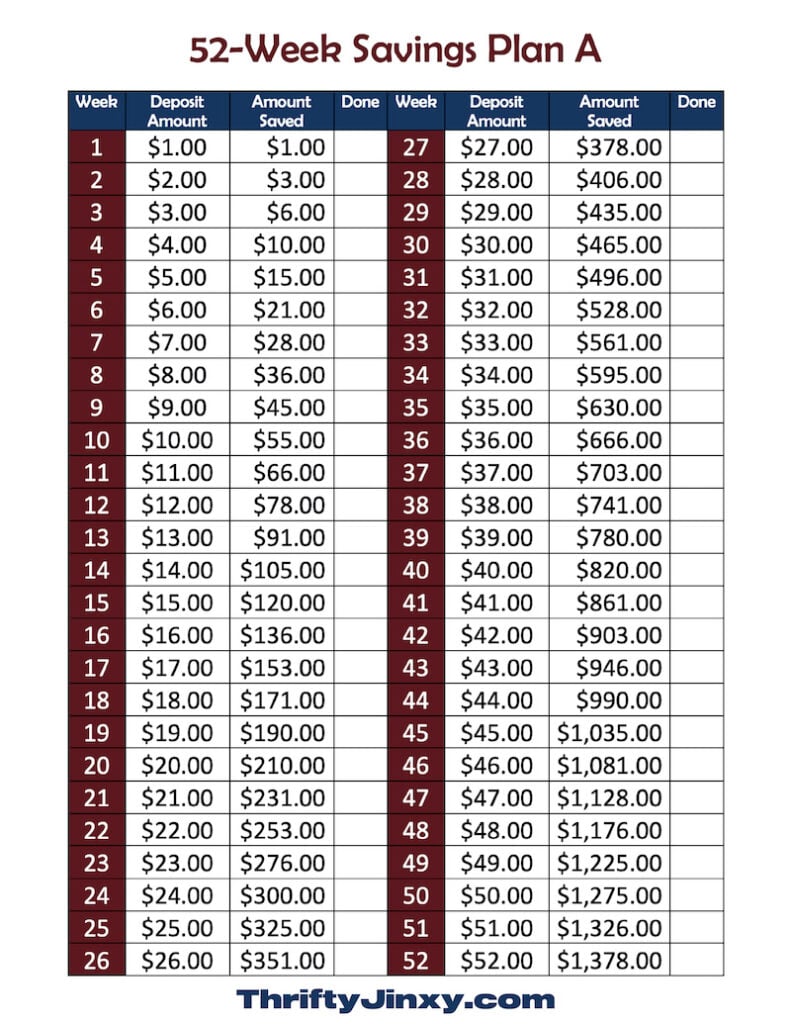

Beginning the first week in January, if you save just $1 and then each week throughout the year – 52 weeks in all – increase the amount you’re saving by just one more dollar, you will save $1,378 by the end of the year.

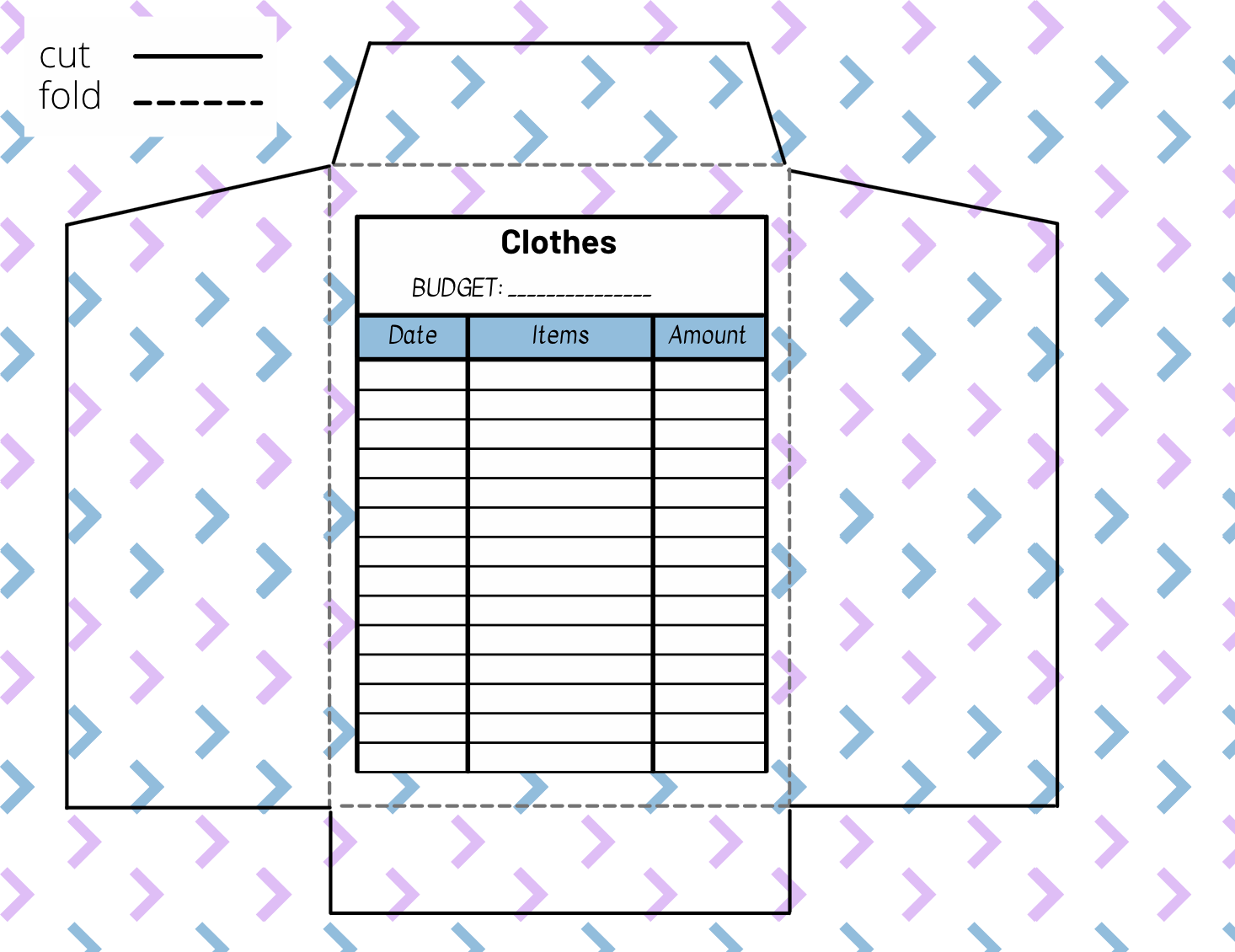

To make following along with the plan easier, we have created a free printable chart to help! Print the 52-Week Savings Plan here. You can check off each week as you go along.

Over $1300. That could be your Christmas shopping cash. Or money saved toward new appliances. Or a family vacation. Or a new car. Or books for the new college semester.

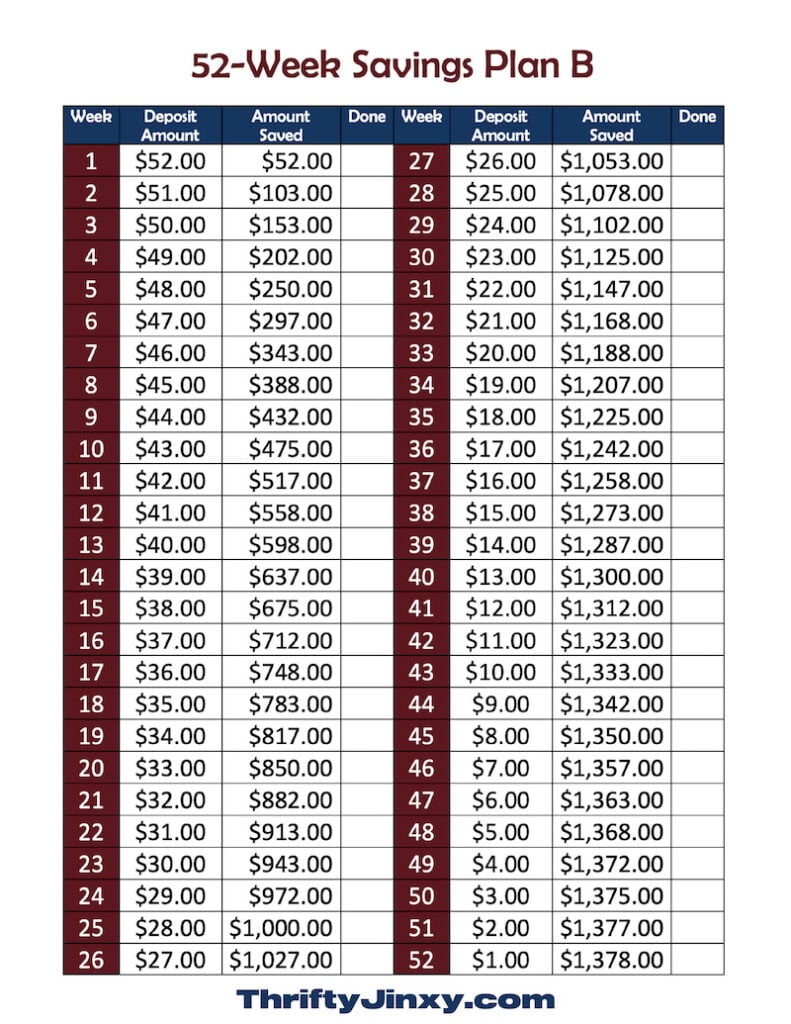

Now I realize not everyone’s brain works the same. There are some of you who might think that it would be easier to start with saving a larger amount the first week and decrease the amount saved by $1 each subsequent week so that it’s a little more effortless as the year flies by.

In your case, I’ve created a second chart just for you…

It’s possible the 52 week savings plan doesn’t work for you. Maybe it’s best for you to save a set amount each week or month and just do it. Maybe your budget won’t support saving more than $20-$30 each month. That’s ok.

It’s also possible that you want to set a goal that’s higher than $1378 for the year. If you’re looking to save somewhere around $2500, you can simply double the amount on the chart each week. They’re YOUR goal and YOUR plan!

However you choose to save, the most important thing is to set a goal, decide on a savings plan and stick to it.

There’s something freeing about knowing that you’re achieving financial stability. Imagine not having to worry about how you’re going to pay for Christmas this year or that new washing machine!

How to Start the 52-Week Savings Plan Later in the Year

Just because you don’t start this savings plan at the beginning of January doesn’t mean you have to wait until next year! There are a couple of different ways you can go about starting it later.

The easiest way is to just start at the beginning and have your plan run into the following year. You’ll still be saving the same amount of money in the same length of time.

If you still want to accomplish the whole savings goal for THIS year, start by saving and marking off the space for the current week. Then, on weeks you’re able to save a bit extra add the amount from one of the previous weeks to your savings and cross off that extra box.

What’s the most creative way you’ve ever saved money?

More Ways to Budget and to Save:

Don’t forget to Pin this post on Pinterest!

Jaclyn says

Thank you for the chart. I will do $200 a month (lump sum or divided into 2 @ $100 a month) instead of weekly. Even number and taken out from my biweekly paycheck.

Carol Graves says

Is they a way to do this savings plan when you only get paid semi-monthly and bi-weekly?

Chrysa says

I think the best way to do this is to tackle the latest TWO boxes every pay period. By doing 2 boxes for each of the 24 bi-weekly pay periods you’ll still end up with covering all 52.

Jill Lake says

I quickly figured out that if you do week 1 then week 52 then week 2 then week 51 you end up with $106 per month each month. That’s more doable for me than $180 to over $200 the last months. Just a thought. Great chart!

Chrysa says

That’s a great idea too! It’s really a great idea to slightly adapt it to what will work for your own life.